Data Centers 2026: The Largest AI Campuses

New Reports Offer a Closer Look at the Super-Sizing of Hyperscale Clusters

I’ve been tracking the super-sizing of data centers and campuses for a lot of years. But the AI boom has turned the dial up to 11, creating massive campuses that dwarf earlier incarnations of digital infrastructure.

As we enter 2026, let’s start with a look at scale. What are the largest AI data center campuses? Where are they located? How much power are they using?

In this article, we’ll take a look at data center size metrics, two new public rankings of the largest campuses, and a list of resources on data center geography and markets.

A Brief History of Huge Data Centers

I’ve been tracking data center supersizing for a lot of years. Back in 2010 I created a special report for Data Center Knowledge titled “Who Has the World’s Largest Data Center?” It explored the largest individual facilities as measured by square footage, which at that time was the best available metric.

It’s not on the DCK site anymore, but we found a copy of the list in the Internet Archive:

The largest building we found was 350 East Cermak, the massive Chicago carrier hotel operated by Digital Realty, at 1.1 million SF.

In 2015 I revisited the topic for Data Center Frontier, shifting the focus from individual buildings to multi-building “cloud campuses.” We were still working primarily with square footage and the number of buildings. This was around the time when power was becoming the key metric, but few providers were disclosing power usage and independent imagery was limited.

In that 2015 story, The Top10 Cloud Campuses, we assessed that the largest campus was the Switch Core campus in Las Vegas, home to the original SuperNAP.

The definitive take on the coming super-sizing of the data center space came in 2018 from Hossein Fateh, who founded CloudHQ (and previously DuPont-Fabros Technology). In “Hyperscale Data Center Deals Will Get Bigger. Much Bigger,” Fateh predicted the world we are now living in:

“The largest deal of 2001 was 3.5 megawatts. That same company leased 35 megawatts from us in 2016. The decimal place moved by a column. The next decimal place will move in 2022. Deals will be 350 megawatts.

“The size of the deals are growing. That’s where we’re going – massive, massive deals.”

SemiAnalysis in 2026: The View from Space

Fast forward to 2026, and there’s lots more data points available to work with, including satellite data, now that space imagery has been revolutionized by cheaper launch vehicles. SemiAnalysis has just released a YouTube video highlighting its take on the 10 largest AI data centers.

Here’s the 12-minute video, which is essential viewing for data center enthusiasts:

The list is based upon the SemiAnalysis Datacenter Industry Model, a paid research product tracking 5,000 facilities around the world. The model is assembled using “publicly available information including but not limited to property records, permits, power usage, FOIA requests, and satellite images. We use computer vision models to accelerate the frequent satellite imaging of datacenters to track size, capacity, timelines, and progress.”

In terms of form factors, SemiAnalysis ranks not just by campus size, but also by multi-campus “AI supercomputers” in which training is spread across multiple campuses, linked by high-speed networking. This ability to train across multiple buildings and campuses is a growing focus for the industry.

That trend is seen across the top two sites, Google clusters in Omaha (including Council Bluffs, Iowa) and Columbus, Ohio (primarily New Albany). Both include multiple campuses, including both AI and cloud workloads. SemiAnalysis estimates that the Google Columbus sites top 1 gigawatt of compute capacity, with about 500 MWs dedicated to AI, slightly ahead of Google and the Meta site in New Albany (which is literally across the street from Google.

When it comes to data center market information, we tend to see some different methodologies and specializations, which present slightly different views of the market. That’s true with assessments of the largest campuses.

Epoch AI: Frontier Data Centers

Another research service providing public data on huge AI data centers is Epoch AI, a non-profit research institute. Their description:

“We examine the driving forces behind AI and forecast its economic and societal impact. We emphasize making our research accessible through our reports, models and visualizations to help ground the discussion of AI on a solid empirical footing. Our goal is to create a healthy scientific environment, where claims about AI are discussed with the rigor they merit.”

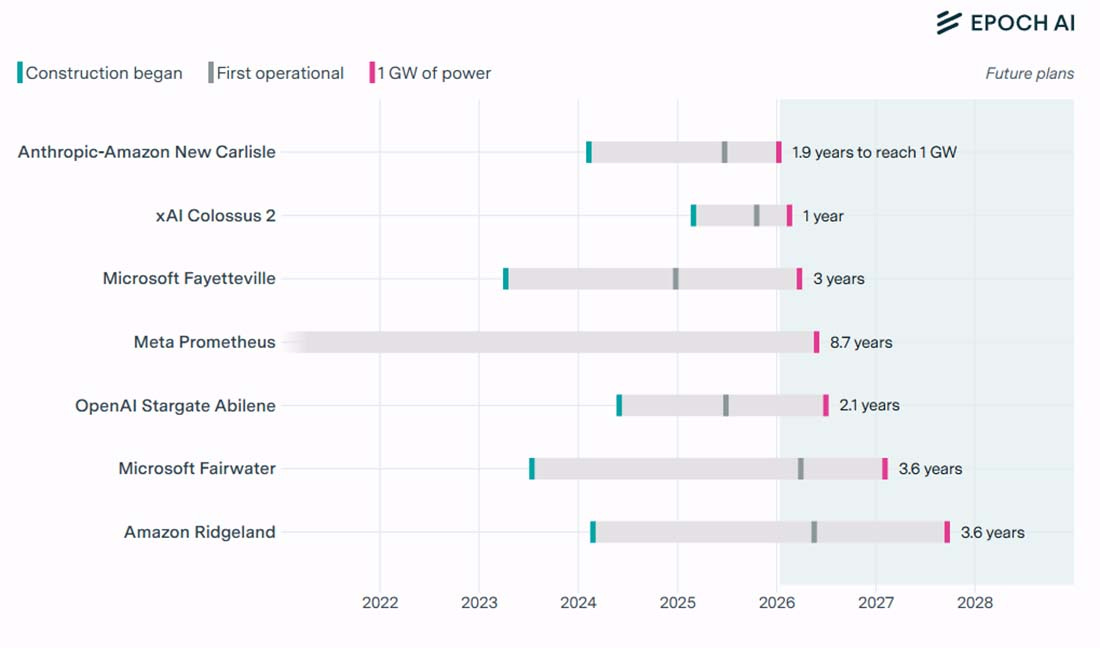

Epoch AI provides detailed info on 17 of the largest AI data center campuses. Although it doesn’t provide a “Top 10” ranking, it tracks each campus on a timeline of when it is estimated to reach 1 gigawatt of deployed IT power capacity. Here’s a chart:

Epoch AI, ‘Frontier Data Centers’. Published online at epoch.ai. Retrieved from ‘https://epoch.ai/data/data-centers’Some of its results vary from SemiAnalysis. As an example, Epoch AI finds that AWS is the first to reach the 1 GW mark with its Project Rainier deployment for Anthropic in New Carlisle , Indiana (which SemiAnalysis ranks fourth).

An interesting way to explore the Epoch AI data is through its map interface, which provides satellite views of each campus.

Epoch AI provides a lot of data, and outlines its methodology while acknowledging there are limits to the accuracy of its projections.

More Resources on Data Center Landscape

SemiAnalysis and Epoch AI are fascinating new players in the data center information landscape. If you’re interested in market data about the sector, you probably will want to get our updates here at Data Center Richness:

Here are other data sources that also provide data center market information:

datacenterHawk - This Dallas-based research firm has some of the best and most thorough data and analysis available, but really distinguishes itself with its public education for data center professionals and investors, with blogs, podcasts and YouTube videos. DCH has gone global in recent years, expanding its research team.

dcByte - Based in London, dcByte offers market intelligence on the global digital infrastructure sector, including informative reports on key geographic markets.

Synergy Research Group - This research firm is notable for its focus on the growth of the hyperscale data center, and shares quarterly reports on this important niche.

Data Center Map - Launched in 2007, DCM was a pioneer in sharing market information in map format, and if you’re scoping out data centers in a particular market, you will likely wind up here.

Advisory Firms - JLL, CBRE and Cushman & Wakefield all provide regular updates with market data and trends in the leading data center regions. These are valuable in tracking the progress of the sector.